We will first look at some of the most common business types and the advantages and drawbacks of each type.

When you need to decide on a Business Type?

Before you actually start a real business you need to take a few important steps. One of the first steps is decided on what legal type of business you will have. Some of the most common options include sole proprietorship, partnership, limited liability corporation (LLC), social purpose corporation (SPC) or non-profit. With a non-profit, you can either have a tax deductible non-profit also called a 501c3 or a more political but not tax deductible non-profit also called a 501c4. Finally, in Washington State, there is a new type of corporation called a Social Purpose Corporation or SPC which is run like an LLC but which can be organized for purposes other than making a profit – making it somewhat like a non-profit organization but with fewer rules. Before we explain the legal steps for starting a business, let’s take a look at the advantages and drawbacks of each of these 7 types of businesses – as the exact steps will vary a little bit based on which type you choose.

Sole Proprietorship

This is the most common form of business mainly because you do not need to draw up Articles of Incorporation or register your business with the State Secretary of State. You merely get a free federal Employer Identification Number (EIN) and a state business license (from the State Department of Licensing) and register with the State Department of Revenue if you will have more than $12,000 in sales per year. You also register with your City and get a city business license. You should also get a business only bank account to place all income and expenses in. You are then legally all set to start selling products. You pay state taxes on your sales and profits and federal taxes on your profits along with your personal income tax filing. You can deduct losses and expenses against other income. However, the drawback of a Sole Proprietorship is that you are personally responsible for any debts incurred by the business including any lawsuit judgments against the business. There is typically almost no cost for setting up a sole proprietorship.

Partnership

This is similar to the Sole Proprietorship except that it is two people who go into business together according to the terms of a written signed agreement between the partners often with one partner supplying most of the funds and the other partner doing most of the work and committing their own time. There is no need to create or file articles of incorporation. But you may need the help of an accountant to sort out the tax liability. A drawback is that both partners are liable for the debts of the partnership.

Limited Liability Corporation (LLC)

The benefit of forming a Limited Liability Corporation is that if the business is sued, it is merely the business that can lose all of its assets rather than the business owner(s) losing all of their assets. Setting up an LLC is a relatively simple process that can usually be done in an hour or less. You need to have three people and write up Articles of Incorporation based on filling in a template. Then get your federal EIN. Then files your Articles of Incorporation with your State Secretary of State. Then file with your State Department of Revenue and get your local business license. Then get your business bank account. The State will charge you for filing an LLC. This cost is about $200.

Social Purpose Corporation (SPC)

This is the newest type of business and currently applies mainly to Washington state – see RCW 23B.03.010. A social purpose organization must be organized in a manner intended to promote positive short-term or long-term effects of, or minimize adverse short-term or long-term effects of, the corporation's activities upon any or all of (1) the corporation's employees, suppliers, or customers; (2) the local, state, national, or world community; or (3) the environment. In plain English, what this means is that an SPC can act like and have the benefits of an LLC without needing to make short term profit its highest priority. Yet at the same time, unlike a 501c3 or 501c4, a SPC can make a profit as long as making a profit is not its primary purpose. The set up process for an SPC is nearly the same as for an LLC. The State will charge you for filing an SPC. This cost is about $200.

Full Corporation

This is the kind of corporation most people are familiar with. It requires having stock holders and holding meetings with strict reporting requirements and strict Articles of Incorporation. You will likely need a lawyer and an accountant to set up this kind of business. Most people start with a simpler business type and then become a full corporation only much later after they are making so much money they do not know what to do with it all. The State will charge you for filing a full corporation. This cost is about $200. But the real cost is paying for attorneys to make sure all of the rules are followed. This cost could be in the thousands of dollars.

501c3 or 501c4 Non-profit

Non-profits are easier to form than a full corporation but harder to form than an LLC or SPC. You not only need your articles of incorporation, you need to supply the IRS with several other documents in order to get their approval. Once approved, the Non-profit is exempt from federal taxation. If the non-profit is a 501c3, they can issue donors with certificates such that donations to the non-profit may also be deducted from federal taxes. The only limitation of a 501c3 is that it may not participate directly in political campaigns. The State will charge you for filing non-profit Articles of Incorporation. This cost typically ranges from $100 to $200. There is also a cost for the IRS review of your Non-profit application. This cost can be several hundred dollars.

Steps to complete after registering your business

After you set up your business bank account, you will need to set up your business accounting system in order to accurately keep track of your business income and expenses for state and federal tax purposes. This is the subject of our next article.

Washington Business organization FACTORS Comparison Table

|

FACTORS |

Sole Proprietor |

General Partnership |

Limited Liability CoRP (LLC) |

STOCK HOLDER FULL Corp |

SOCIAL PURPOSE CORP (SPC) |

|

REGISTER WITH WA SECRETARY OF STATE |

No |

No |

Yes |

Yes |

Yes |

|

FORMATION Difficulty |

Low |

Low |

Medium |

High |

Medium |

|

Liability |

Sole proprietor has unlimited liability |

Partners have unlimited liability |

Members are not typically liable for the debts of the LLC |

Shareholders are not typically responsible for the debts of the corporation |

Members are not typically liable for the debts of the SPC |

|

Operational Requirements |

Relatively few legal requirements |

Relatively few legal requirements |

Some formal requirements but less formal than corporations |

Board of directors, annual meetings and annual reporting required |

Some formal requirements, but less formal than corporations |

|

Management |

Sole proprietor has full control of management and operations |

Typically each partner has an equal voice, unless otherwise arranged |

Members have an operating agreement that outlines management |

Managed by the directors, who are elected by the shareholders |

Members have an operating agreement that outlines management |

|

Federal TAXATION |

Sole proprietor pays all taxes via 1040 & can deduct losses against other sources of income. |

Each partner pays tax on his/her share of income & can deduct losses against other sources of income |

Typically there is no tax at the entity level. Income/loss is passed through to members |

Taxed at the entity level. If dividends are distributed to shareholders, dividends are also taxed at the individual level |

Typically there is no tax at the entity level. Income/loss is passed through to members |

|

Washington Excise Taxation and Liability (WASHINGTON Department of Revenue) |

Taxes based on business entity income. |

Taxes based on business entity income. |

Taxes based on business entity income. Responsible parties may have liability for trust funds. |

Taxes based on business entity income. Responsible parties may have liability for trust fund taxes |

Taxes based on business entity income. Responsible parties may have liability for trust funds. |

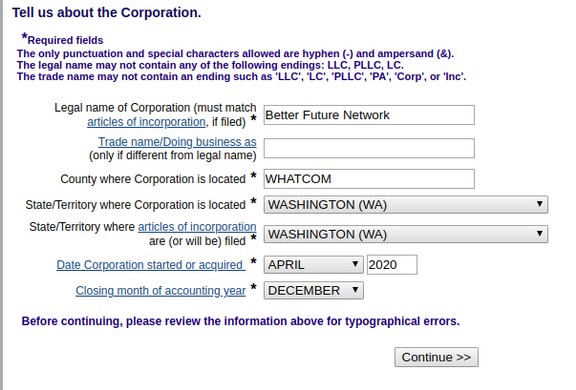

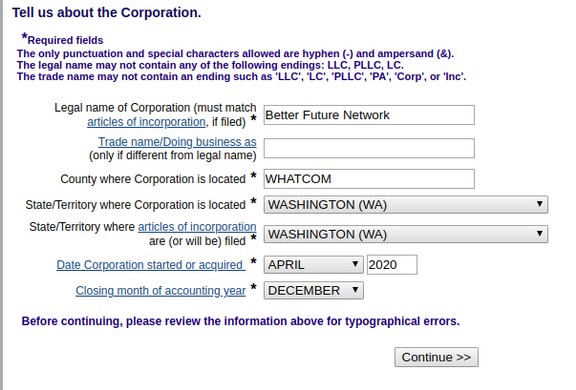

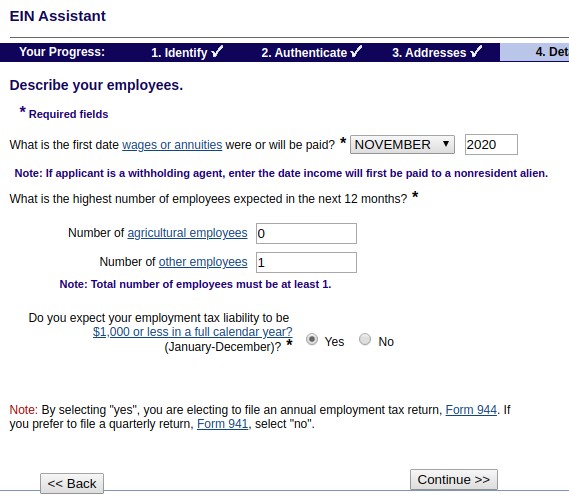

An example of forming a Social Purpose Corporation in Washington state

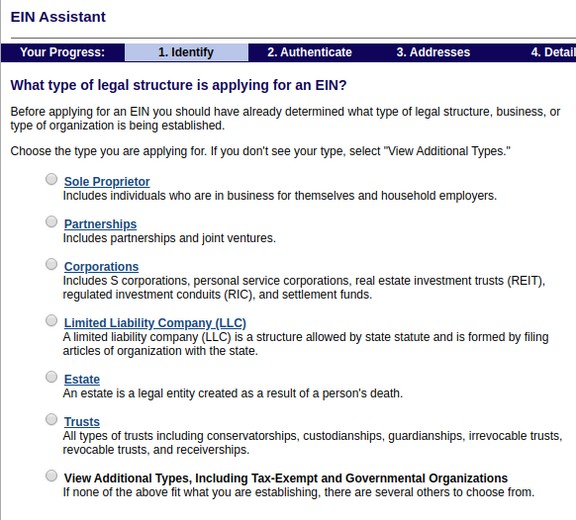

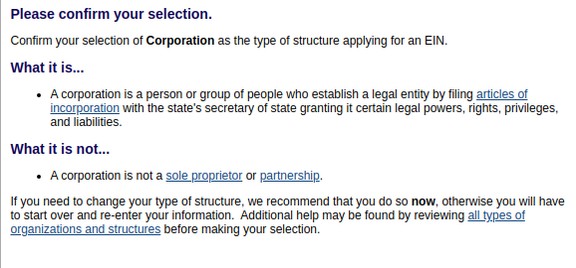

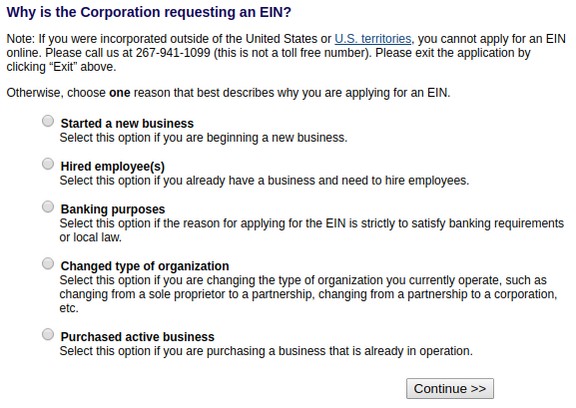

The first step is getting the Employer Identification Number (EIN) from the IRS. This is a simple online form that takes just a few minutes to complete. Make sure that you do not list any employees when you are first starting your new business. Here are some steps for this process:

Choose corporation.

Choose corporation again.

Click continue

Click start a new business

Then enter your name and social security number

check I am president Then continue

then corporate address and click Continue.

Click continue twice.

Check yes to last question.

Do annual. for do click other. then organization. then social education then receive online then click submit.

Additional Information about your EIN

This EIN is your permanent number and can be used immediately for most of your business needs, including opening a bank account, applying for business licenses and filing a tax return by mail. However, it will take up to two weeks before your EIN becomes part of the IRS's permanent records. You must wait until this occurs before you can file an electronic return or make an electronic payment.

Second, draft your Articles of Incorporation, Bylaws and Minutes. Samples of these are available from David Spring via email request. You will need at least three people to form a Social Purpose corporation.

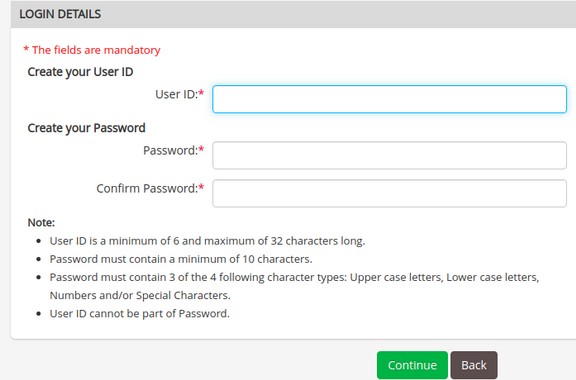

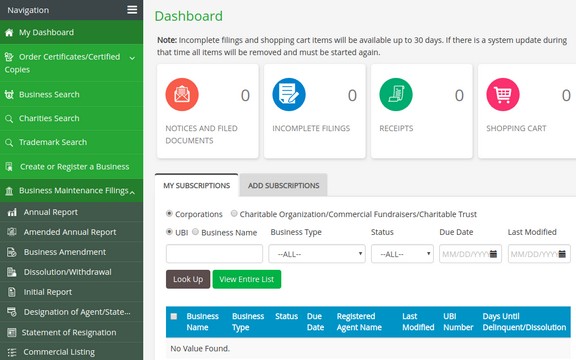

Third Register the Washington state Secretary of State website

Then in the top menu, click Corporations. Then click on Corporations Filing System and click Create a User Account. Then click Free User Account. Then click Individual, then continue

Create a User ID and Password. Then complete the contact information screen. Then click continue. Then fill in the address. Then click register. Then click the verification email. Then log into the account.

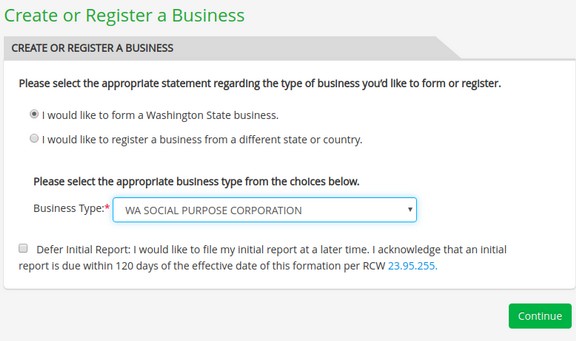

In the left side menu, click Create or Register a Business. Then check Washington state business.

Click continue.

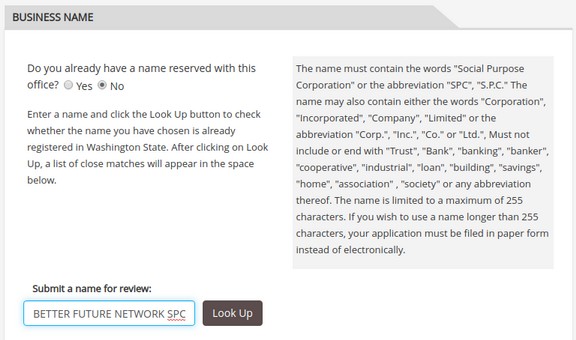

Enter the name of your Social Purpose Corporation with the SPC included. For example, Better Future Foundation SPC. Then click Lookup. Hopefully, the name will be available. Then scroll down and copy paste the information from your Articles of Incorporation including Business Purpose.

General purpose (click boxes)

And specific purpose (copy and paste from Articles of Incorporation).

Then make a PDF of the signed articles of incorporation and upload them. Then add yourself as an incorporator and as governor

Nature of Business: check any lawful purpose. Check email opt in.

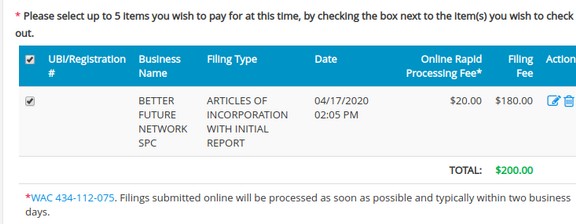

Authorized Person: enter yourself and use the title Chairperson. Then check the Execution box. Then click Save. Then click Continue. Then review the application and click Add to Cart

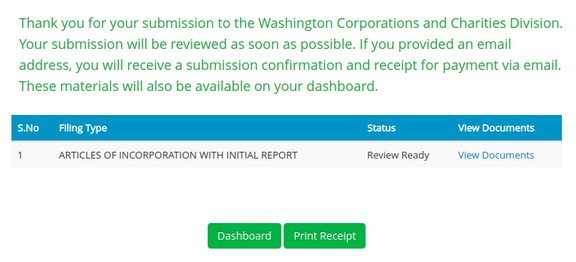

Then pay $200. Click checkout. It takes two days to process the form

Click Print Receipt. Click View documents

Download all three documents. Then go back to the dashboard.

You are done. You should be approved in two days. Log out. You can then use this information to get your business bank account.

What’s Next?

In the next article, we will review how to set up a Business Chart of Accounts.