In this article, we will show you how to keep track of your business income and your business expenses. Money coming in and money going out are called Financial Transactions. The whole point of a Financial Management Program is to keep track of and organize all of your business financial transactions.

There are several reasons you need to keep track of your business income and expenses. First, you not only need to tell whether you are making a profit or loss on the entire business, but also where you are making the most money and where you are losing the most money. You will stay in business longer if you keep track of the various sources of your income and the various categories of your expenses.

Second, if you want to persuade other people to invest in your business so you can grow your business more rapidly, you will need to be able to prove to them that you are making a real profit – not merely that you have a good idea. Third, you will have to file precise reports to the state and federal government if you make more than a few thousand dollars a year. And if you have a real business, at some point you will be making several thousand dollars per year in sales. The government will allow you to deduct your business expenses from your business sales to determine your net business income. But to get these deductions, you have to define all of your expenses by very specific categories.

Thirty years ago, in the days before personal computers, one of the first things any new business owner would do was purchase a Business Ledger Book. This ledger book was essentially a series of big pages with each page containing a giant table with 20 to 30 rows and 10 to 20 columns. Each row was a new transaction – an income deposit or an expense withdrawal. Each column was a different kind of income or a different category of expense. At the bottom of each page, the business owner would add up all of the rows and columns to make sure each page balanced.

These ledger page totals would then be added up to make sure each day, each week and each month balanced and that everything matched the monthly statement from your bank.

Today, with computers, many small business owners using spreadsheet programs such as Libre Calc or Microsoft Excel, to keep track of transactions (the rows) and accounts (the columns or categories of expenses).

But spreadsheets can be difficult to work with. So in 1983, a couple of computer programmers started Quicken, a program for tracking personal income and expenses. They later added Quickbooks, a program for tracking business income and expenses. But there are a couple of big problems with Quickbooks. The first problem is price. It costs $300 to install Quickbooks on your computer. It costs over $300 per year to use the Cloud version of Quickbooks. Many new business owners do not have an extra $300 per year.

The second problem is a lack of security. Quickbooks is only available for the Windows operating system and we now know that the Windows operating system is not very secure. It is therefore relatively easy for hackers to break into Windows computers. Once inside your computer, hackers can cause major problems for your business accounting system. The solution to both the cost and security problem is to replace the Windows operating system on your computer with the Linux operating system. Linux does not have open back doors and is much more secure than Windows. Once you have a Linux computer, you can install a free business accounting system called GnuCash with just the click of a button.

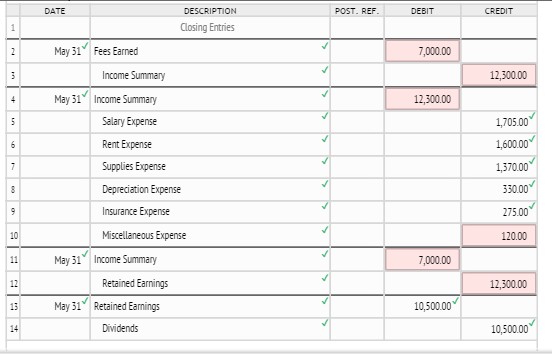

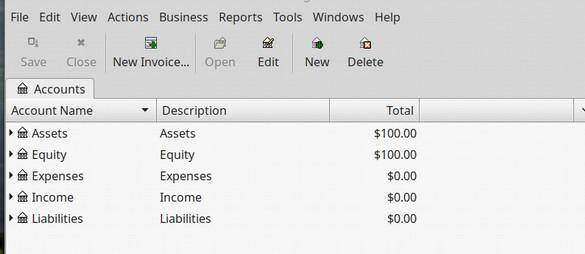

Here is a screen shot of a GnuCash Main Menu and Chart of Accounts. It took less than 3 minutes to install this business accounting system:

GnuCash is not quite as elaborate as Quickbooks. But it is free and relatively easy to use. GnuCash is therefor just right for someone on a budget who wants to start a new business and wants a way to keep track of all of their business financial transactions.

GnuCash has dozens of important features:

We will only use a few of these features in this course. But we are listing all of them to help you understand how GnuCash can help you keep track of your business funds as your business grows.

#1 Easy to get started. You can easily import data from and export data to a spreadsheet program or another accounting program.

#2 GnuCash, like Linux is open source and is therefore very secure. This means that experts are free to review and audit the source code to make sure there are no security holes in the source code. Also your financial data is securely stored on your computer in your file system rather than somewhere in the cloud.

#3 GnuCash is relatively easy to learn because it uses a simple check register structure of deposits and withdrawals.

#4 GnuCash has numerous ways to learn more about how to use it including a free 150 page Help Manual and free 240 page detailed guide as well as numerous online guides and Youtube videos. For more information, visit their website: GnuCash.org.

#5 A simple one click process for creating a standard IRS compliant system of business accounts. You can set up the default business system of accounts in less than 5 minutes.

#6 A simple process for adding your own custom chart of business accounts and tracking your own custom business transactions. You are not limited to the default system of accounts.

#7 Separate accounts for separate businesses. Not only can you have as many accounts as you need, you can set up different account systems for different businesses and use GnuCash on as many businesses as you wish. No need for expensive separate licenses for every business and every business employee. Have one set of books for your for profit business and another set of accounts for your non-profit business.

#8 Processes for creating and tracking many common business transactions including invoices, vendors, customers, bill payments, billing terms, discounts and tax rates for accounts payable and receivable.

#9 30 Financial Reports and Graphs...GnuCash comes with Financial Reports, Charts, Graphs and Forms including Cash Flow, Income and Expense Statement, Balance Sheet, Profit and Loss Statement, Equity, Taxes and Net Worth Statements, Vendor Reports and Payables and Receiving Statements (to see which vendors need to be paid and which customers are running late in paying you). The "custom report" feature allows a number of different elements to be combined in a single report.

#10 Scheduled Transactions: GnuCash allows you to set up routine transactions for set amounts, while still being flexible enough for you to make changes or postponements.

#11 Vendor and Transaction Matching and Searching functions. No need to remember the name of each and every vendor or customer or the date of a particular transaction. GnuCash Search function will help you find any given supplier, customer or transaction.

#12 Multiple currency support... for working with overseas customers and suppliers.

#13 Custom Invoicing… GnuCash allows you to create and print your own customized invoices designed for your business.

#14 Check Printing: Print standard business checks or develop a more customized layout. Charge state, county, and local sales tax and print statements to attach to payments.

#15 Payroll Management: With Accounts Receivable and Accounts Payable options, you can use GnuCash for many common payroll activities. You can also use GnuCash to track and pay employees and consultants and even have employees fill out expense reports.

#16 Business Mortgage & Business Loan Repayment: GnuCash can help you set up payment plans, not just for business loans, but for auto loans and investor loans.

#17 Budget and Planning Tools: In addition to managing your company’s finances, you can balance your own budget too using GnuCash’s checkbook style register.

#18 Reconcile bank and credit card statements. GnuCash can do bank statement and credit card statement reconciliation

#19 Import Functions… The ability to import data directly from your online bank account using either CSV import or OFX, QFX import.

#20 Exportation Functions: Come tax season, you can export all your data from GnuCash into your favorite tax preparation software – or whatever software program your tax accountant might prefer.

#21 Complex Accounting and Tax Functions including depreciation and amortization. GnuCash also has a mechanism for assigning tax categories to income and expense accounts — a useful tool for filling out tax forms.

#22 GnuCash is available in 29 languages making it ideal for new business owners no matter what their native language is.

#23 GnuCash uses the standard Big Five System of Basic Business Accounts and allows you to set up as many sub accounts under each as you want.

#24 GnuCash uses industry standard “double entry” accounting practices to make sure that all five of your major accounts always remain in balance.

#25 You do not need to actually learn Double Entry Accounting. You simply enter the transaction in your business checkbook and GnuCash automatically makes the second entry for you!

What is a business account?

Recall that the whole point of setting up an accounting system is to keep track of and organize your business financial transactions (or the money coming into and going out of your business). But before you can record the transactions of your business, you need to set up accounts or categories to enter the transactions into. The term "Account" is simply a set of similar transactions that have all been put in the same folder on your computer. For example, you can have an account named "Office Supplies" to record all transactions related to buying stationery.

A business account is also useful for keeping track of what your business owns, owes, spends or receives. Some accounts keep a running total of balances such as your checking account and savings account. Other accounts categorize money you receive or spend such as whether you spent the money on supplies or on advertising. Dividing your business expenses into categories of expenses allows you to keep better track of how your money is being spent.

One of our first task is to create our system of accounts. Thankfully, GnuCash comes with an excellent default system of accounts that we can create with just the click of a button. This Business System of Accounts is organized using the Big Five Basic Business Accounts. So let’s take a closer look at these five most important accounts.

What are the Big Five Basic Business Accounts?

All business transactions can be placed into one of these 5 accounts:

#1 Assets — things you own including anything with value you could sell for cash.

#2 Liabilities — things you owe including any amounts you need to pay back to investors and suppliers.

#3 Equity — overall net worth or what is left over after subtracting all of your business liabilities from your business assets. If your business has no debt, then your assets equals your equity.

#4 Income — money your receive from your customers which increases the value of your asset and equity accounts

#5 Expenses — money you give to suppliers for goods and services which decreases the value of your asset and equity accounts. There are two main kinds of expenses. If you pay for a given expense immediately, you will decrease your assets or your bank balance. If you are given credit and therefore pay the expense at a later date, you increase your liabilities which is another way of saying that you increase your long term debt.

These big five account types are often divided into two broad groups:

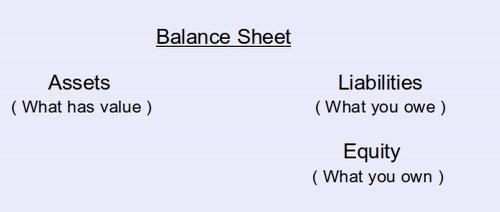

Balance Sheet accounts (Assets, Liabilities, Equity)

Income and Expense Statement accounts (Income, Expenses)

Balance Sheet Accounts are used to track the changes in value of things you own or owe. Here is what a balance sheet looks like:

The reason that the equity is listed on the right side or liability side of the balance sheet is because the equity is what the business owes to the owner of the business.

Three Versions of the Same Accounting Equation

The Accounting Equation is a way of determining your equity if you know your assets and liabilities. From the above, we can see that:

Assets = Liabilities + Equity.

Put another way, your equity or Net Worth equals your assets minus your liabilities: Equity = Assets – Liabilities

You increase equity through income, and decrease equity through expenses: Assets - Liabilities = Equity + (Income – Expenses)

Income and expense accounts are accounts that increase or decrease the value of your assets, liabilities and equity. Here is what an Income and Expense Statement typically looks like:

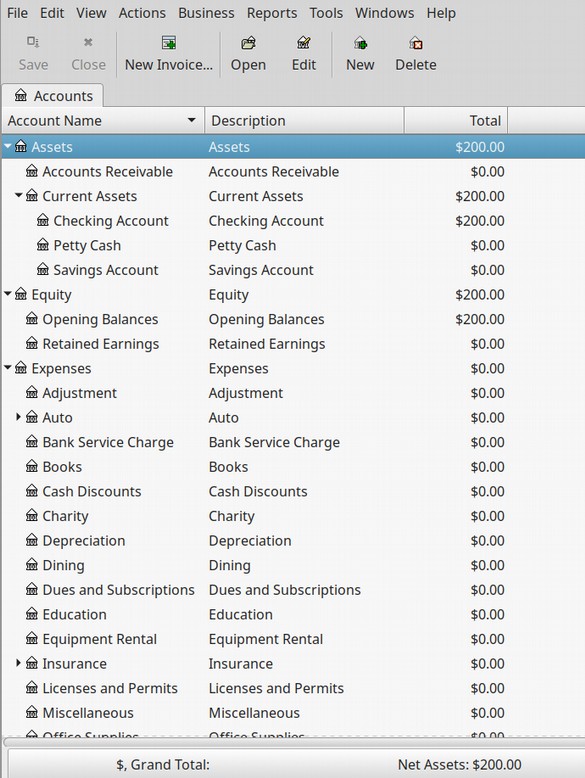

The Reason for Double Entry Accounting… To Keep your Accounts in Balance

The above Accounting Equation must always be in balance. The only way to keep it in balance is, with each transaction, to post the transaction on both sides of the Accounting Equation. Put another way, all five basic accounts have a Debit Side and a Credit Side. Think of the word CREDIT as in someone giving you credit or a loan… A Credit is not a good thing, it is a bad thing. Also note that a DEBIT is not the same as a DEBT. In fact, it is the opposite of a debt. The words Debit and Credit can be very confusing for most people. Thankfully, GnuCash allows us to avoid these terms by using Deposits instead of Debits and Withdrawals instead of Credits

#1 Assets... things you own: Debits increase your assets while credits decrease your assets.

#2 Liabilities... things you owe: Debits decrease your liabilities while credits increase your liabilities.

#3 Equity... overall net worth: Debits decrease your net worth or equity while credits increase your net worth or equity.

#4 Income... increases the value of your accounts: Debits decrease your income while credits increase your income.

#5 Expenses... decreases the value of your accounts: Debits increase your expenses while credits decrease your expenses.

What is Double Entry Book Keeping?

Double Entry accounting means that every transaction affects both sides of the accounting equation. For example, if you obtain a $200 business loan, you have increased your assets by $200. But you have also increased your liabilities or debt by $200. With each transaction, your goal is balance the accounting equation by making adjustments in two accounts. We will practice double entry bookkeeping with a GnuCash Sandbox account. One way to learn how to use GnuCash is to jump right into the deep end of the pool by creating a system of accounts for your real business. If you make a mistake and enter the wrong amount to the wrong account, you can go back and delete it. But the deletion process is not always obvious.

A much better way to learn how to use GnuCash is by creating a fake business account also called a Sandbox account. This way, if you make a few mistakes you can simply delete the fake account and start all over by creating an entirely new account. Set up your Chart of Accounts with your Sandbox Account. Then practice several transactions using fake vendors and fake customers. Once you are confident with how GnuCash works, then delete the fake account by deleting the folder it is in – and then starting over by creating your real business account.

How to Install GnuCash

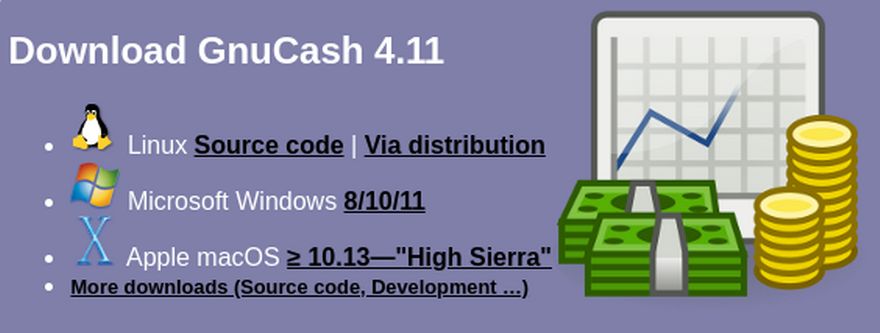

The easiest way to install GnuCash on a Linux laptop is to click on the Menu, then click on the Software Manager. Then type the word GnuCash into the search box. Then click on GnuCash and click the Install button. However, the Software manager version is very old. If you go to the GnuCash.org website, you will see that the most recent version of GnuCash is version 4.11

We will therefore install Gnu Cash using the terminal. Go to your menu and click on the terminal to open it. Then copy paste the following line into the terminal.

sudo apt install gnucash

Type your user password (no asterisks feedback) when it prompts and hit Enter to continue.

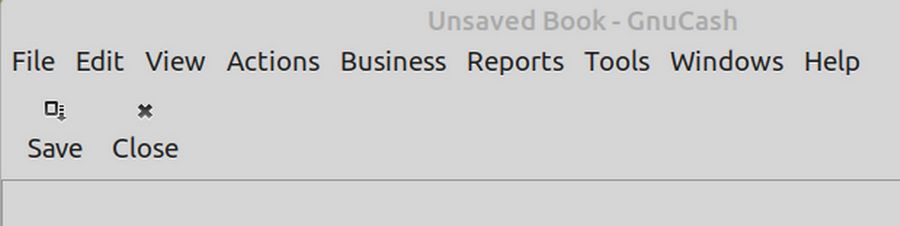

Then enter Y when asked and press Enter on your keyboard. Once installed, you can open the program by going to Menu, Office, GnuCash. Uncheck and Close the Tip of the Day. Here is the starting screen after closing the Tip of the Day screen:

Click Help, About to see that the current version is 3.8.

How to Set Up your Sandbox Business Account

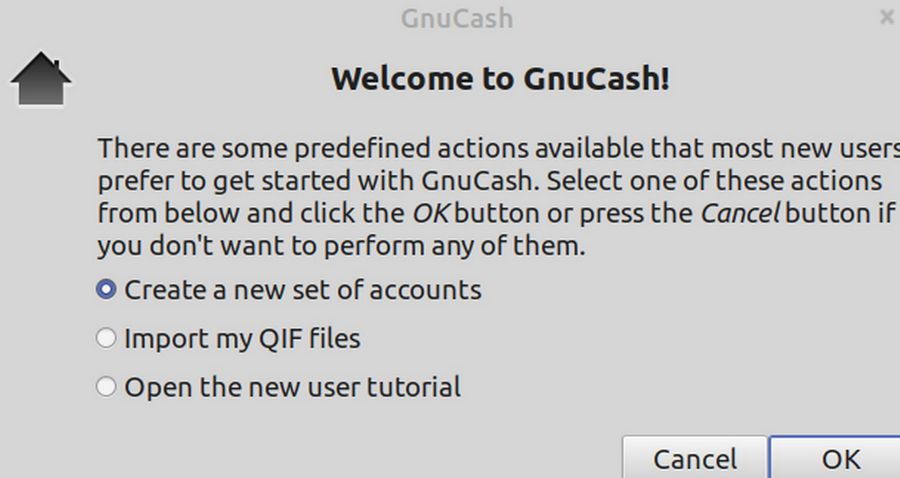

The first time you open Gnu Cash, you should also see this screen:

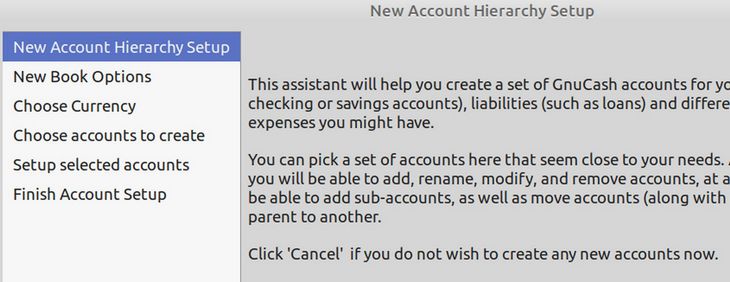

Click OK to create a new set of accounts. We will set up a Sandbox account called Lemonade Stand Test Account. Clicking on File, New File will also bring up the New Account Hierarchy Setup Wizard:

Note: What GnuCash calls a New File is in fact a giant folder that all of your business transactions will go it. If you have more than one business, then you will create a different GnuCash file (or a different folder) for each business.

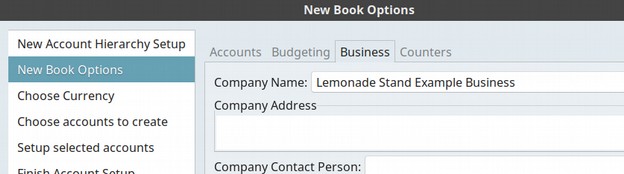

Click Next. Then click on the Business tab and enter the name of your test business:

Note: To reach this same screen after completing the Set Up Wizard, in case you want to make changes and additions to your Business Account information, in the GnuCash top menu, just click on File, Properties, Business. For now, just type in the business name. Then click Next. Leave the currency set for US and click Next.

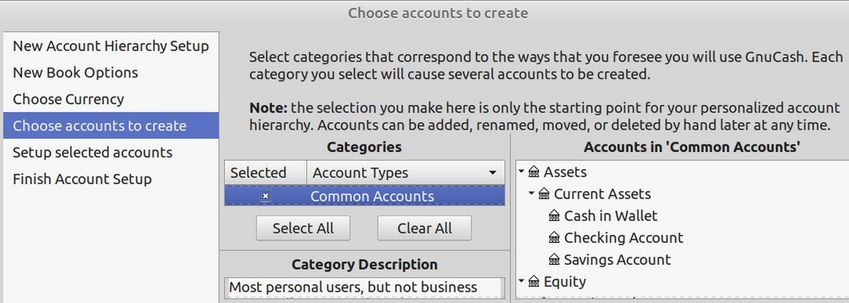

The Choose Accounts to create is an important page. By default, it is set to create a Common Account or Personal Account. We want to change this to a Business Account. So first un-check the Common Account box. Then scroll up to the Business Accounts and check this box. Then click Next.

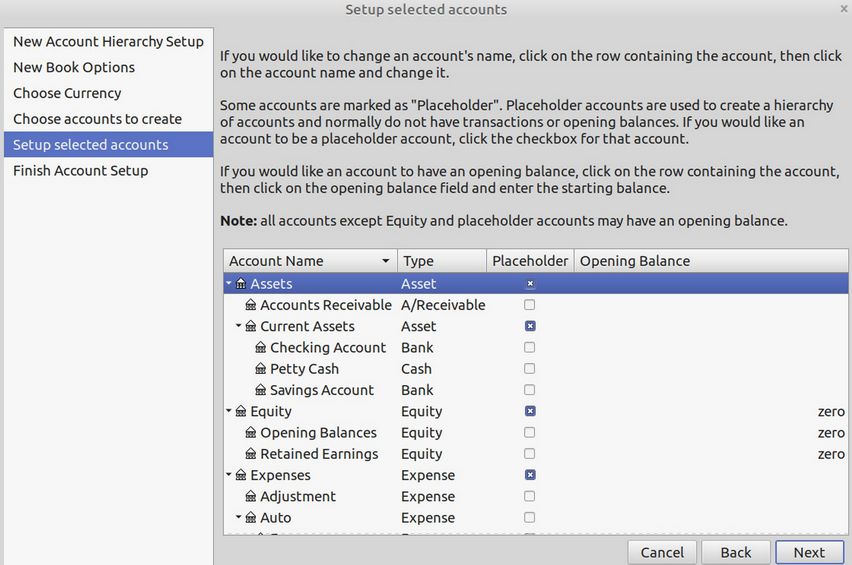

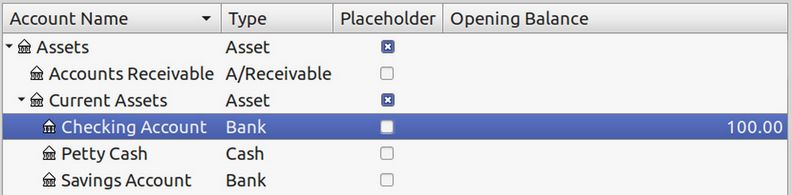

Here we want to add an initial deposit to our checking account. Click on the Checking Account Row. Then move your cursor to the right to be in the Opening Balance column and click on the space to open the box.

Type in 100.00. Then be sure to PRESS ENTER. Then click Next. Then click Apply. This will bring up your file manager.

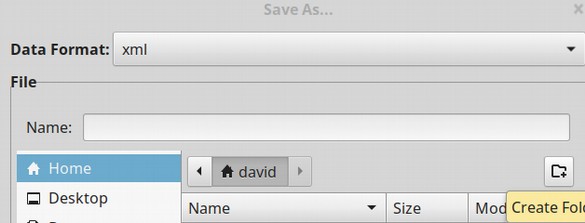

Click on the icon on the right to create a new folder.

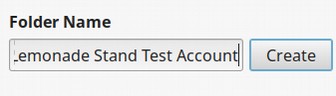

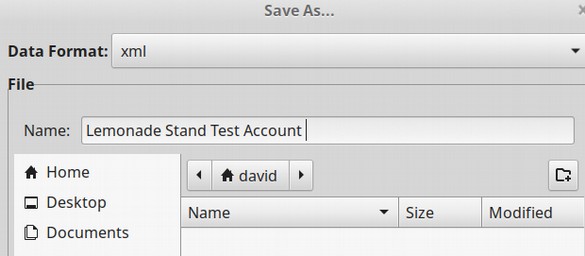

Name the folder the name of your test business. Then click Create. Then name the file the name of your test business:

Then click Save As in the lower right corner. This will bring up your Test Business opening screen:

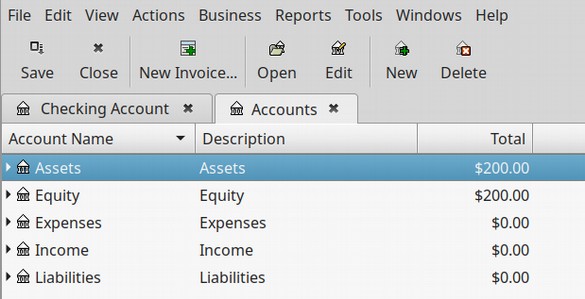

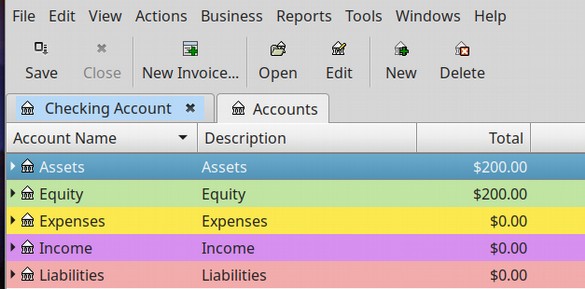

Note that GnuCash has already set up your Big Five Business Accounts for you. GnuCash has also automatically added $100 to your equity. Remember our Accounting Equation: Equity = Assets minus Liabilities. You created $100 in Assets when you deposited $100 in your checking account. GnuCash automatically adds any deposits to your equity in order to keep your accounts in balance.

Record some simple business transactions

Now that we have set up our business accounts, in this lesson we will review how to enter or record basic business transactions.

How to Make a New Deposit to Your Business Checking Account

If for some reason, your initial screen shows no assets or equity, you can make a deposit by clicking on Assets. Then click on Current Assets. Then click on Checking Account to select it. Then click Open in the top menu or right click and click Open Account.

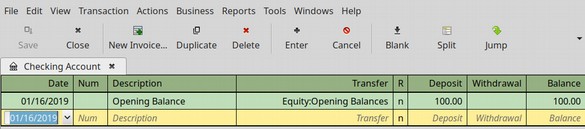

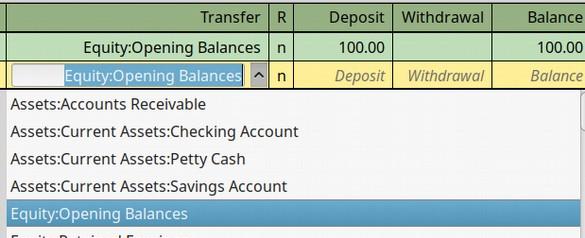

In the yellow box, for the Description column, type Initial Deposit. Then click on the Transfer Column to bring up the Drop Down Arrow box.

Click Equity Opening Balance so that GnuCash knows what this deposit is being made for. Then in the Deposit column, type 100.00. Then Press Enter. Then press Save. Then press Close.

How to Delete a Transaction

If you made a mistake or want to delete a deposit, just select the row and want to delete a deposit, just select the row and click Delete in the top menu. In case you are wondering what the R and N mean in the table above, the R stands for Reconciled and the N stands for Not Reconciled. At the end of each month, when you get your statement from your bank, you want to review all of your transactions to make sure you and your bank agree on what happened. You then want to click on the N and change it to C meaning that your account has been reconciled with your bank statement. To Save the Changes you made to your checking account, always remember to click SAVE. Then Close.

How to Open Your Chart of Accounts

To open your Chart of Accounts, in the top menu click View, New Accounts Page.

How to Customize Your Account Preferences

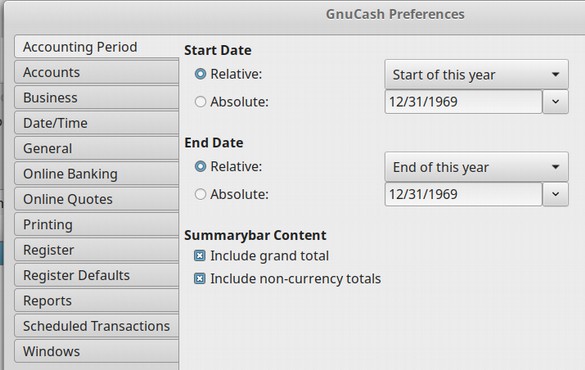

Before we make any more changes, we will review our Account Preferences. In the top menu, click on Edit Preferences.

There are just a couple of things we want to change here. Click on Accounts side menu item. Then for Account Color, check the boxes to show the Account Color as background and on tabs. This will help us see our different accounts more clearly. Then click on the Business side menu item. Check the box to Enable Extra Buttons. We can use these buttons later to make custom invoices for our business. Click on the Printing Side Menu and change the default font from 10 to 14. Then click Close.

Customize Your Account Colors

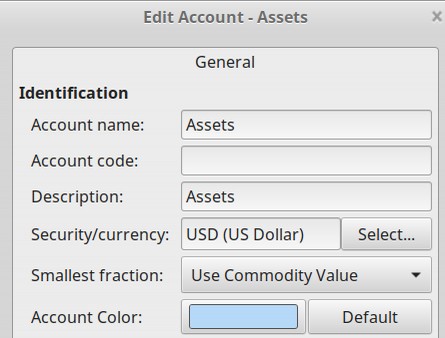

You can change the background color of any account by selecting the account and then clicking on Edit. Then click on the Account Color.

Select the color you want. Then click OK. Here are our Big Five accounts after adding colors to each of them.

Now that we have our top level accounts looking nice, lets add some more accounts made especially for our Lemonade Stand Business.

How to Add New Accounts

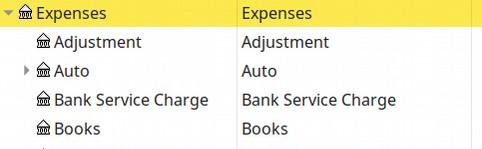

We can customize GnuCash by adding as many accounts as we want. The default Business Chart of Accounts Expenses Category comes with over 20 different types of expenses. 7 of these expense types have sub categories (which have little arrows to the left of their account name – see Auto below).

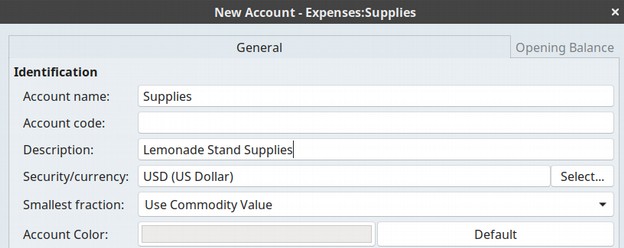

We want to add a new category for our Lemonade Stand Example Business called Supplies. To add this new account, first select the Expenses Row. Then click New.

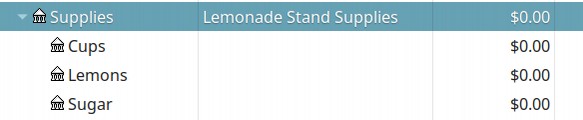

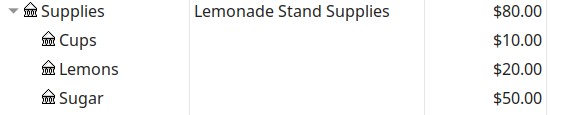

For Account Name, type Supplies. For Description, type Lemonade Stand Supplies. Because this is just a placeholder account in which all expenses will be posted to three sub-level accounts (cups, sugar and lemons), we want to check the Placeholder box. Then click OK. Then on the main accounts page, open the expense category. Then scroll down to Supplies. Then click New to add our first sub-category to this account. Call this account Cups. Then click OK. Then add an account for Sugar and an account for Lemons. Here is what our Supplies accounts look like when we are done.

How to record purchases and deposits

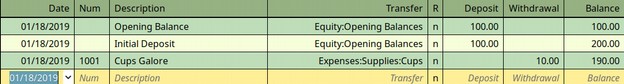

We are now ready to buy our Lemonade Stand supplies. Most kids just go to the local grocery store and pay full price for their supplies. However, we can save money by seeking out wholesale supplies and buying each item in bulk. We will buy our Cups from Cups Galore. They will sell us a box with 1000 cups for $10 or one penny per cup. To enter this expense in our accounting system, click on the Check Register in your Chart of Accounts. Then open it. For Number, write the number on the check of the date of the transaction. For Description, write Cups Galore.

For the Transfer type, click on the arrow and select Expenses, Supplies, Cups. For withdrawal, type 10.00. Then press Enter.

Then click Save. Then click Close.

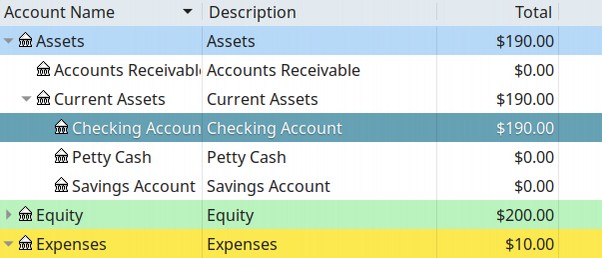

We now have only $190 in Assets all of which is in our Checking Account. But we still have $200 in Equity because the $10 we spent on cups is counted as an Asset. It is our inventory of cups.

We will next buy a box of 50 lemons from a company called Lots of Lemons for $20 and record this transaction in our check register.

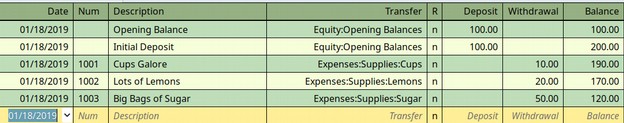

Last, we will buy 10 five pound bags of sugar from a company called Big Bags of Sugar for $5 per bag or a total of $50. Because we have gotten a “resellers license” when we registered our business, there is no sales tax on any of these transactions because sales tax is only on retail sales. Here is what our Check Register now looks like:

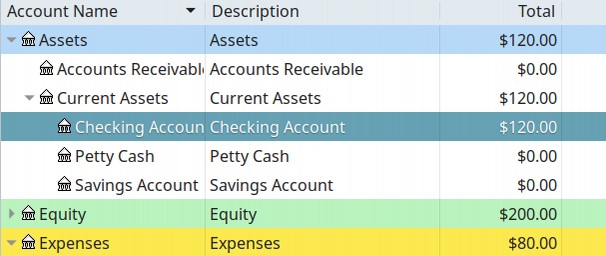

Here is what our Chart of Accounts now looks like:

Here is what the Expenses: Supply Accounts now look like:

Your cups are only 10 cents each. Your lemons are only 40 cents each and the sugar for an entire jar of lemonade is less than 50 cents. By keeping your costs low, you can sell lemonade for a low price and still make a big profit.

You are now ready to start mixing your lemonade and selling to customers. At the end of each day, add up all of the sales you made and deposit them in your real business bank account. Also record the deposit in your GnuCash Check Register. Each deposit will increase your Assets and increase your Equity.

What’s Next?

There is much more than GnuCash can do for you as your business gets bigger and your supplies start giving you credit terms. But for now, we will next review some final steps for setting up your online business website.